The Federal Court has ordered ridesharing platform Uber to pay a penalty of $21 million after Uber admitted it had engaged in misleading or deceptive conduct and made false or misleading representations to consumers in its app and on its website, in proceedings brought by the ACCC.

Uber admitted it breached the Australian Consumer Law by engaging in misleading conduct and making false or misleading representations in relation to cancellation messages and the price of Uber Taxi rides.

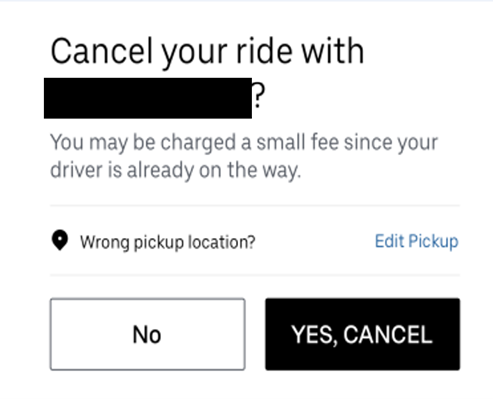

In particular, Uber admitted the cancellation message it displayed between at least December 2017 and September 2021 was misleading because it stated users may be charged a cancellation fee if they cancelled their trip, even if those users were seeking to cancel during Uber’s ‘free cancellation period’.

The cancellation message which stated ‘You may be charged a small fee since your driver is already on their way’ was amended by Uber in September 2021 in response to the ACCC’s ongoing concerns. Uber agreed that more than two million consumers saw the misleading cancellation message.

Uber also admitted the price range estimate for an Uber Taxi ride (a service available only in Sydney) displayed to consumers on Uber’s app and website from July 2018 until the service was discontinued in August 2020, was false and misleading. The price range estimate displayed was higher than the actual Uber Taxi fare most of the time. Uber agreed more than a thousand consumers used the Uber Taxi option each week where they were shown inaccurate price estimates.

The ACCC filed proceedings on 26 April 2022, and at that time both parties jointly submitted to the court that a penalty of $26 million was appropriate.

“This $21 million penalty clearly signals to businesses that misleading consumers about the cost of a product or service is a serious matter which can attract substantial penalties,” ACCC Chair Gina Cass-Gottlieb said.

“We note Justice O’Bryan’s statement that the ordered penalty should not be understood as any reduction in the Court’s resolve to impose penalties appropriate to achieve the statutory objective of deterring contraventions of the Australian Consumer Law.”

Uber agreed some Uber group employees were aware of issues with its Uber Taxi fare estimates and cancellation messaging. Uber has acknowledged it did not monitor the functionality of the algorithm to ensure the accuracy of the Uber Taxi fare estimates it produced in Australia.

Uber also admitted that the incorrect cancellation fee statements may have caused some individuals to decide not to cancel their ride. The incorrect Uber Taxi fare estimates meant consumers could not accurately evaluate the cost of an Uber Taxi and make informed decision about their transport choices.

“We took this important case because we understand that consumers rely on apps, like the Uber app, to provide accurate information to inform their purchasing decisions because they cannot independently check or monitor whether the information displayed is accurate,” Ms Cass-Gottlieb said.

Uber was also ordered by consent to implement a compliance program, not to make similar representations about cancellation fees to consumers for the next three years, publish a corrective notice on its website, and to pay a contribution to the ACCC’s costs.

Background

In April 2022, the ACCC instituted proceedings against Uber in the Federal Court with an agreed statement of facts and joint submissions proposing a $26 million penalty, after Uber admitted that its conduct had contravened the Australian Consumer Law.

The Uber Group operates in over 700 cities worldwide. It develops and operates technology applications, including the Uber rideshare app and Uber Eats app, which connect consumers with independent providers of ride services and food delivery services. Uber B.V. is a Netherlands company and subsidiary of United States based company Uber Technologies Inc. which is the ultimate holding company in the Uber Group.

Uber B.V. makes the Uber website and app available to consumers in Australia and published the taxi fare information and the cancellation warning messages.

According to Uber’s cancellation policy, for the UberX, Uber Comfort and Uber Premier services, there is a free cancellation period of five minutes after acceptance of booking. For the Uber Pool service, the free cancellation period is one minute after acceptance of a booking.

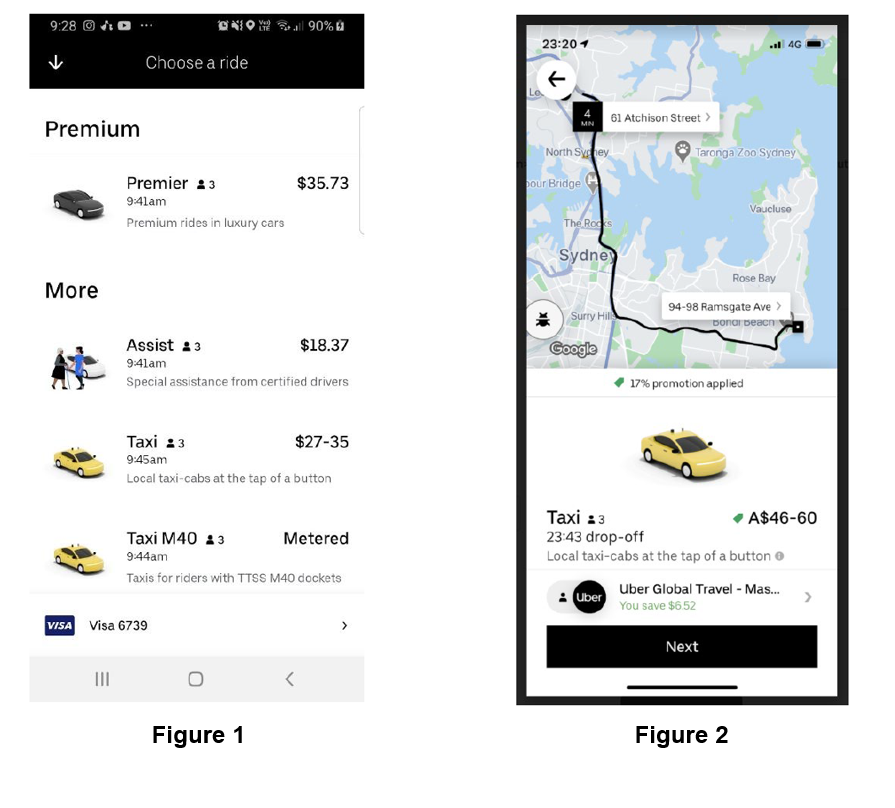

The following screenshots of the Uber App taken when the conduct was occurring show examples of the misleading representations.

Example of an image of the cancellation screen

Example of Uber app screenshots showing the Taxi option and fare estimate range